As a platform designed to empower small retailers and micro-businesses, PayNearby offers seamless financial services, allowing businesses to extend basic banking facilities, bill payments, and money transfers to their customers. Through PayNearby, retailers can increase footfall, expand their services, and generate additional income.

Understanding PayNearby Retailer Login?

The PayNearby Retailer Login is the portal through which authorized retailers can access the suite of financial services offered by PayNearby. This login acts as a gateway to the platform, providing retailers the ability to offer services like Aadhaar-enabled Payment System (AEPS), Domestic Money Transfer (DMT), mobile recharges, and more to their customers.

Benefits of PayNearby for Retailers

Using PayNearby brings several benefits to retailers, including:

- Increased Revenue: Retailers can earn commissions for each transaction processed through PayNearby services.

- Improved Customer Loyalty: Offering essential financial services helps build stronger relationships with customers.

- Wide Range of Services: From utility bill payments to insurance services, retailers can offer a full range of solutions.

How to Register as a PayNearby Retailer?

Before accessing the PayNearby Retailer Login, you need to register as a retailer on the platform.

Steps for Retailer Registration:

- Visit the official PayNearby website or download the PayNearby mobile app.

- Click on “Become a Retailer” or “Sign Up.”

- Enter your mobile number and other requested details.

- Provide necessary documents (more on this below).

- After approval, you will receive login credentials.

Documents Required for Registration:

- Aadhaar Card

- PAN Card

- Bank Account Details

- Proof of Shop or Establishment

Once these details are verified, you can proceed with your retailer login.

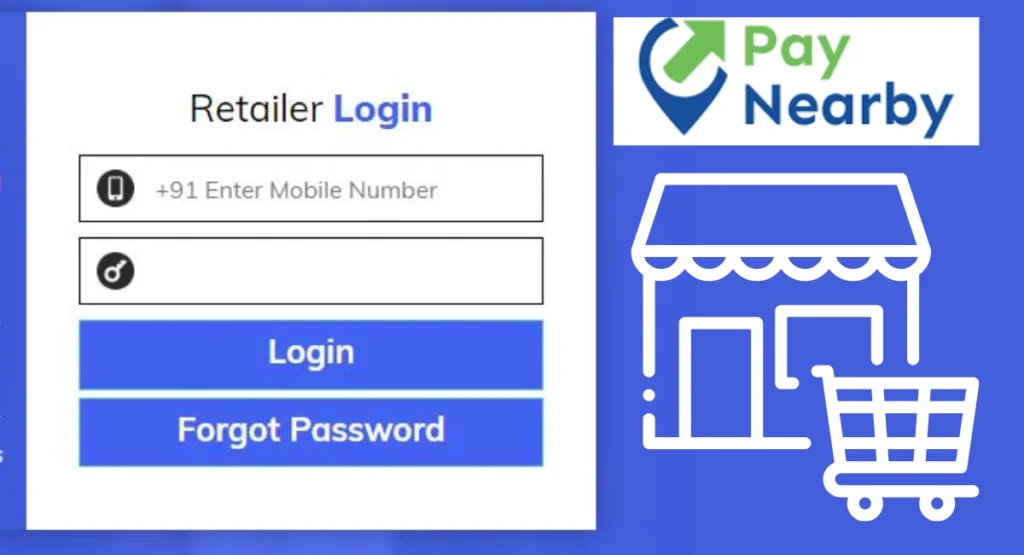

How to Access PayNearby Retailer Login?

The PayNearby Retailer Login can be accessed in two primary ways:

- Through the official website (using a web browser).

- Through the PayNearby mobile app.

Both methods provide a simple and secure way for retailers to access their accounts and begin using the platform.

Step-by-Step Guide to PayNearby Retailer Login

Logging in via Web Browser:

- Visit the PayNearby website.

- Click on “Retailer Login” at the top right corner.

- Enter your registered mobile number and password.

- Complete the OTP verification (if required).

- Click “Login” to access your dashboard.

Logging in via Mobile App:

- Download the PayNearby mobile app from the Google Play Store.

- Open the app and select “Retailer Login.”

- Enter your credentials—mobile number and password.

- Authenticate with the OTP sent to your mobile number.

- Once verified, you will be directed to the dashboard.

Also Read : AJIO Seller Login | OSSSC Login | Becric Login

Features Available After Logging In

Once logged in, retailers gain access to multiple features:

AEPS Services:

Aadhaar-enabled Payment System allows retailers to offer banking services such as cash withdrawal and balance inquiry using the customer’s Aadhaar number and fingerprint authentication.

Bill Payments:

Retailers can process utility bill payments, DTH recharges, and mobile recharges for customers, making it a one-stop solution for many.

Money Transfers:

With the Domestic Money Transfer (DMT) service, retailers can help customers transfer funds easily to any bank account within India.

Other Services:

Additional services include insurance distribution, ticket bookings, and various financial products like loans and savings schemes.

Troubleshooting Common PayNearby Login Issues

Encountering issues during login? Here’s how you can fix some common problems:

Forgotten Password or Username:

Click on the “Forgot Password” link on the login page and follow the steps to reset your password via OTP.

OTP Issues:

Ensure that your mobile number has network connectivity. If you’re not receiving the OTP, try resending it or restarting your phone.

Browser Compatibility Problems:

Make sure you’re using an updated web browser like Google Chrome or Mozilla Firefox. Clear your cache if the login page fails to load.

Mobile App Glitches:

Ensure that you’re using the latest version of the PayNearby app. If it crashes frequently, try reinstalling it or clearing app data.

Security Features of PayNearby Retailer Login

To ensure the safety of retailers’ accounts, PayNearby integrates strong security protocols:

Two-Factor Authentication (2FA):

This extra layer of security requires users to verify their identity through an OTP sent to their registered mobile number.

Regular Password Updates:

Retailers are encouraged to change their password regularly to prevent unauthorized access.

How to Reset PayNearby Retailer Login Password?

If you forget your password, follow these steps to reset it:

- Go to the login page and click on “Forgot Password”.

- Enter your registered mobile number and the OTP sent to your phone.

- Follow the prompts to create a new password.

Importance of Regularly Updating Retailer Information

To ensure smooth operations, it’s important to regularly update your personal and business information, such as contact details and bank account information, on the PayNearby platform.

1. Managing Transactions After Logging In

After logging in, you can view all your recent transactions on the dashboard. The detailed history helps track earnings and service fees for better financial management.

2. Using the PayNearby Dashboard Effectively

The PayNearby dashboard is user-friendly and allows retailers to navigate through services, check transaction history, download receipts, and monitor their earnings easily.

3. PayNearby Login Customer Support

If you face issues logging in, you can reach out to PayNearby’s customer support:

4. Contacting PayNearby for Login Assistance:

- Helpline Number: Available on the website.

- Email Support: Send an email to their support team for assistance.

- Chat Support: Available on the app and website for real-time help.

Conclusion

The PayNearby Retailer Login is the gateway to a powerful platform that empowers small businesses and retailers to provide essential financial services. By following the steps outlined in this guide, you can easily access your account and leverage the full range of services offered. From handling customer bill payments to facilitating money transfers, PayNearby helps retailers not only grow their income but also serve their communities better.

FAQs

How do I register as a PayNearby retailer?

You can register by visiting the PayNearby website or app and following the registration process. You’ll need documents like Aadhaar and PAN card for verification.

What should I do if I forget my PayNearby retailer password?

Use the “Forgot Password” option on the login page to reset it via OTP sent to your registered mobile number.

Why am I not receiving the OTP during login?

Check your network connection or restart your phone. You can also try resending the OTP.

Can I access PayNearby services through a mobile app?

Yes, PayNearby has a dedicated mobile app that allows retailers to log in and access all services on the go.

What services can I offer as a PayNearby retailer?

You can offer services like AEPS transactions, money transfers, utility bill payments, and insurance distribution.